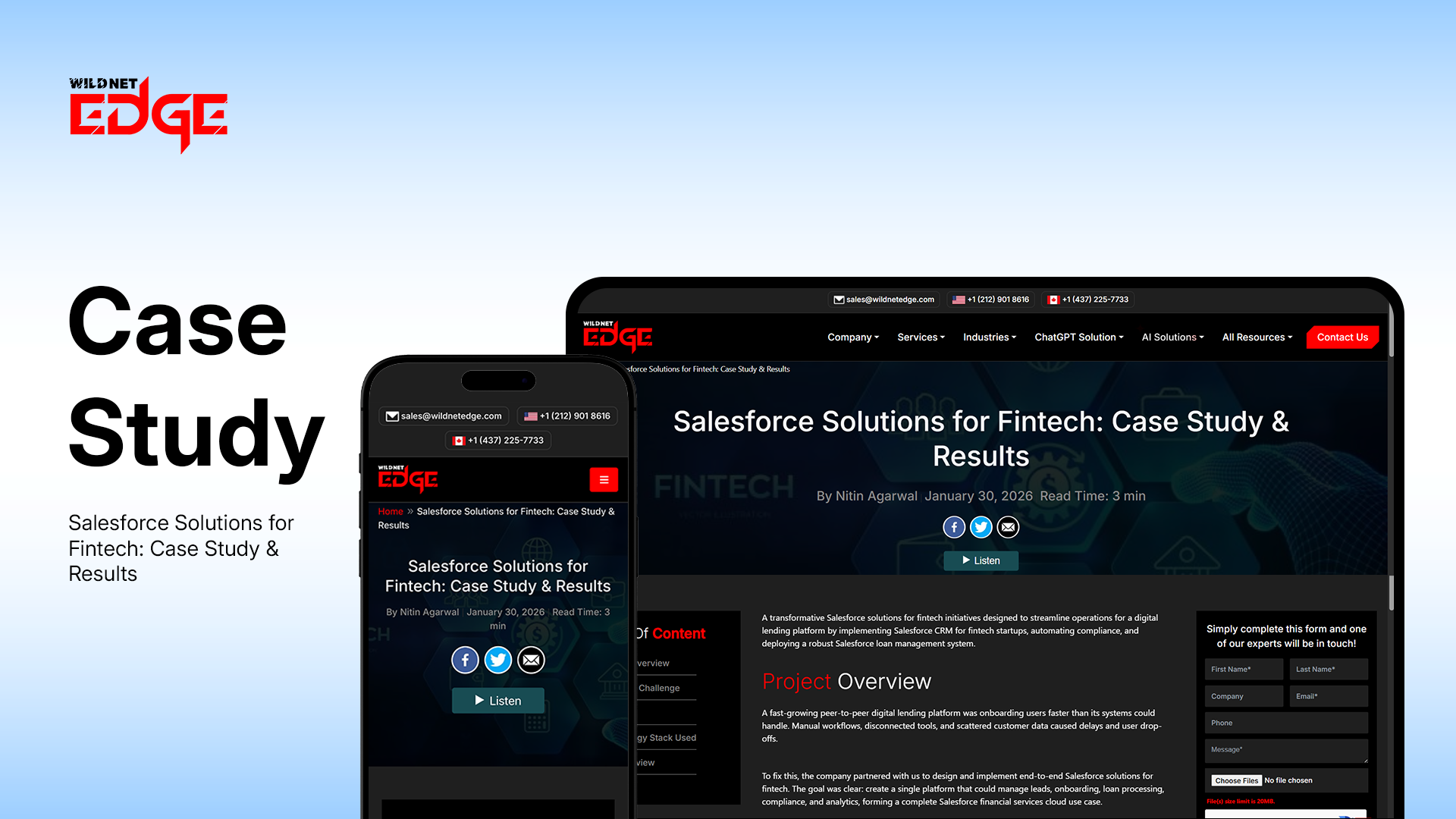

A transformative Salesforce solutions for fintech initiatives designed to streamline operations for a digital lending platform by implementing Salesforce CRM for fintech startups, automating compliance, and deploying a robust Salesforce loan management system.

Project Overview

A fast-growing peer-to-peer digital lending platform was onboarding users faster than its systems could handle. Manual workflows, disconnected tools, and scattered customer data caused delays and user drop-offs.

To fix this, the company partnered with us to design and implement end-to-end Salesforce solutions for fintech. The goal was clear: create a single platform that could manage leads, onboarding, loan processing, compliance, and analytics, forming a complete Salesforce financial services cloud use case.

Business Challenge

Inefficient Customer Onboarding

The KYC process relied heavily on manual checks and email-based approvals. This slowed onboarding to several days and led to a 40% user drop-off rate. The team needed Salesforce customer onboarding fintech workflows that could verify users quickly and securely.

Complex Regulatory Compliance

Handling financial compliance manually increases risk and audit stress. The client required Salesforce compliance automation with strong Salesforce data security fintech controls to protect borrower data and meet regulatory standards without constant manual oversight.

Disconnected Loan Processes

Loan origination lived outside the CRM. This caused delays, duplicate data entry, and frequent errors. Without Salesforce workflow automation, fintech and loan officers spent more time updating systems than closing loans.

No Actionable Insights

Critical business data sat in spreadsheets. Leadership lacked real-time visibility into loan performance and portfolio risk. They needed Salesforce analytics for fintech to make informed decisions quickly.

Scaling Pains

As a startup, the company needed technology that could grow with them. Implementing Salesforce CRM for fintech startups was essential, but they also needed to hire Salesforce Developers who understood fintech-specific workflows and scalability.

Solution

Comprehensive Salesforce Solutions for Fintech

We designed a full Salesforce solution for fintech roadmap and migrated the platform to Salesforce Financial Services Cloud. This created a single source of truth for customer, loan, and compliance data, forming the foundation of their Salesforce financial services cloud use case.

Automated Onboarding and Compliance

We built Salesforce customer onboarding fintech workflows that integrated identity verification and document checks. Onboarding time dropped by 90%. With Salesforce compliance automation, every customer record follows predefined security and regulatory rules, strengthening Salesforce data security and fintech across the platform.

Streamlined Loan Management

We developed a custom Salesforce loan management system directly inside the CRM. This enabled automated credit checks, approval workflows, and loan tracking. Using Salesforce workflow automation fintech, loan officers could process applications faster and focus on high-value tasks, showcasing true Fintech CRM automation.

Advanced Analytics and Reporting

With Salesforce analytics for fintech powered by Tableau CRM, the client gained real-time dashboards for loan performance, risk exposure, and customer activity. These insights replaced guesswork with data-driven decisions and improved portfolio health monitoring.

Custom Development & Resource Augmentation

We delivered custom Salesforce solutions to integrate external credit bureaus and third-party tools. To maintain momentum, the client chose to hire Salesforce Developers from our team, ensuring their Salesforce solutions for fintech continued to evolve as the business grew.

Scalable Architecture for Startups

We optimized Salesforce CRM for fintech startups to stay lightweight while supporting enterprise-grade features like Fintech CRM automation. This balanced cost control with long-term scalability.

Technology Stack Used

- Salesforce Financial Services Cloud

- Salesforce Experience Cloud

- Apex & Lightning Web Components

- MuleSoft (Integration)

- Tableau CRM (Einstein Analytics)

- Salesforce Shield (Encryption)

- DocuSign Integration

- REST API

Client Review

“Implementing these Salesforce solutions for fintech completely turned our business around. The Salesforce loan management system automated 80% of our manual work. We were able to hire Salesforce Developers who truly understood Salesforce CRM for fintech startups. The Salesforce analytics for fintech now drives our daily strategy, and Salesforce compliance automation gives us complete peace of mind. This Salesforce financial services cloud use case proves how custom Salesforce solutions can scale a fintech business.”

Nitin Agarwal is a veteran in custom software development. He is fascinated by how software can turn ideas into real-world solutions. With extensive experience designing scalable and efficient systems, he focuses on creating software that delivers tangible results. Nitin enjoys exploring emerging technologies, taking on challenging projects, and mentoring teams to bring ideas to life. He believes that good software is not just about code; it’s about understanding problems and creating value for users. For him, great software combines thoughtful design, clever engineering, and a clear understanding of the problems it’s meant to solve.

sales@wildnetedge.com

sales@wildnetedge.com +1 (212) 901 8616

+1 (212) 901 8616 +1 (437) 225-7733

+1 (437) 225-7733

ChatGPT Development & Enablement

ChatGPT Development & Enablement Hire AI & ChatGPT Experts

Hire AI & ChatGPT Experts ChatGPT Apps by Industry

ChatGPT Apps by Industry ChatGPT Blog

ChatGPT Blog ChatGPT Case study

ChatGPT Case study AI Development Services

AI Development Services Industry AI Solutions

Industry AI Solutions AI Consulting & Research

AI Consulting & Research Automation & Intelligence

Automation & Intelligence